Introduction

The dynamic nature of software projects, characterized by changing requirements, technological advancements, and unforeseen challenges, demands a proactive and strategic approach to budget control.

This comprehensive blog explores the essence of cultivating a software budget control mindset, offering insights and strategies to ensure financial stability and precision throughout the lifecycle of software projects.

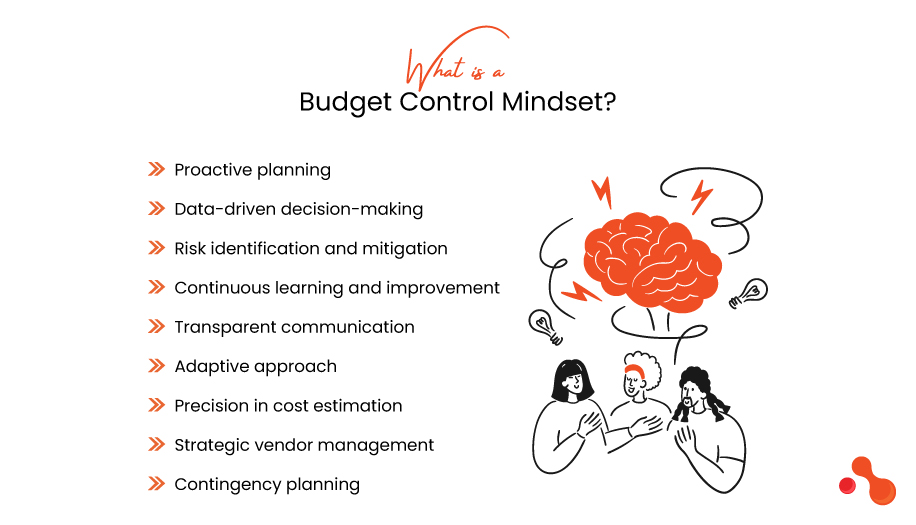

What is a Budget Control Mindset?

The budget control mindset in software development is an overarching approach that emphasizes foresight, flexibility, and continuous improvement in financial planning and management. It’s about anticipating potential budgetary issues, adapting to changes without compromising financial health. This also includes learning from each project to refine future budgets.

It refers to a set of attitudes, principles, and approaches that individuals and organizations adopt to manage and control budgets effectively.

Here are key elements that characterize a budget control mindset:

- Proactive planning

- Data-driven decision-making

- Risk identification and mitigation

- Continuous learning and improvement

- Transparent communication

- Adaptive approach

- Precision in cost estimation

- Strategic vendor management

- Contingency planning

- Quality assurance focus

- Post-implementation considerations

- Client-centric collaboration

- Efficient resource utilization

- Legal and regulatory compliance focus

Importance of Precision Budget Control

Precision budget control is of utmost importance in various aspects of business and project management. Here are key reasons why precision in budget control is crucial:

- Ensures that resources, including manpower, technology, and materials, are optimized efficiently.

- This accuracy is crucial for creating realistic budgets, preventing cost overruns, and allowing organizations to allocate funds effectively.

- Identify potential risks early in the project or business cycle.

- Ensures financial stability by preventing budget deviations.

- It instills confidence in decision-making.

- Contributes to client trust and satisfaction.

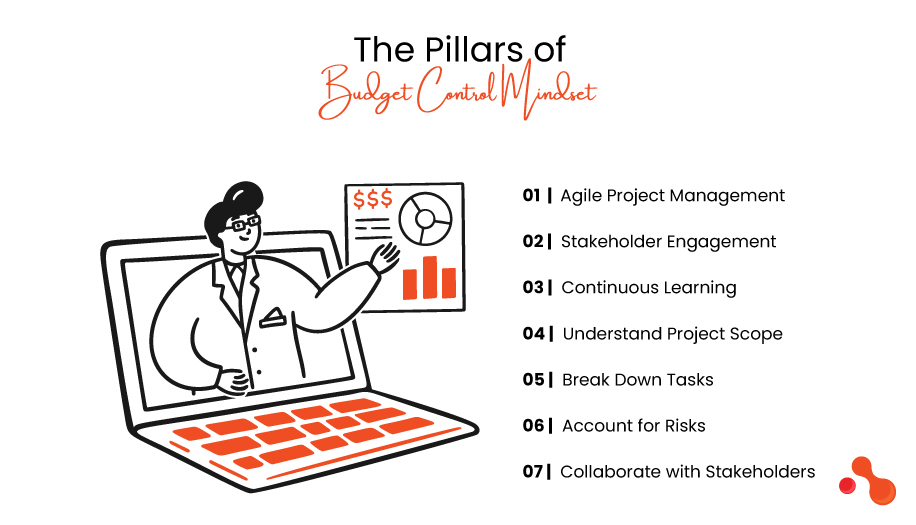

The Pillars of Budget Control Mindset

Proactive Planning: Anticipating costs and risks early in the project lifecycle to create a realistic and flexible budget.

Agile Project Management:

Adapting to changes in project scope, resources, and timelines while keeping the budget aligned with project goals.

Stakeholder Engagement:

Ensuring continuous communication with stakeholders about budget status, risks, and adjustments.

Continuous Learning:

Applying lessons learned from past projects to improve budget estimation, management, and control processes.

Understand Project Scope:

Begin by thoroughly understanding the project scope. What features or functionalities are essential? What are nice-to-haves? Clear requirements will guide your budgeting process.

Break Down Tasks:

Divide the project into smaller tasks or user stories. This granularity allows for more accurate estimation and better resource allocation.

Account for Risks:

Identify potential risks that could impact the project timeline or budget. Allocate contingency funds to handle unforeseen challenges.

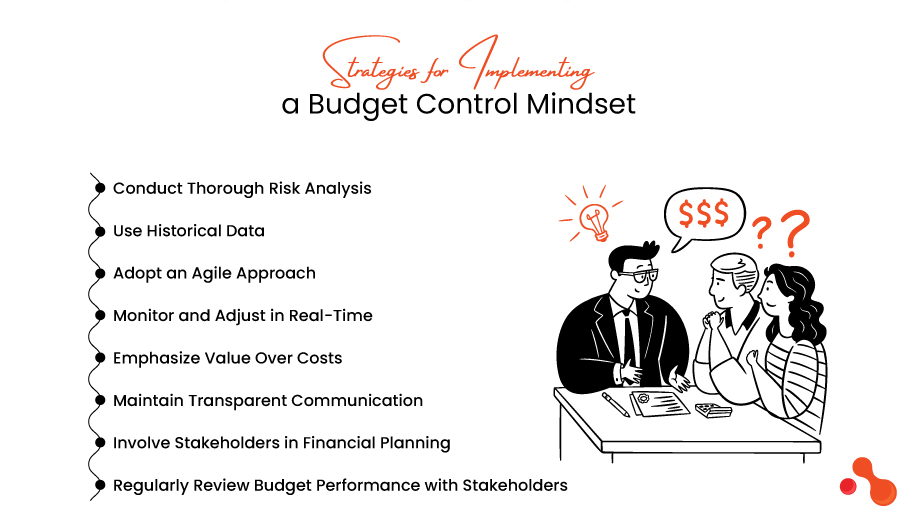

Strategies for Implementing a Budget Control Mindset

Define Clear Project Objectives and Scope:

Establishing a clear understanding of the project’s goals and boundaries is the first step in proactive budget planning. This clarity helps in avoiding scope creep and ensures that budget estimations are aligned with project expectations.

Conduct Thorough Risk Analysis:

Identifying potential risks and their financial implications early allows for the inclusion of contingencies in the budget, reducing the impact of unforeseen challenges.

Use Historical Data:

Leverage data from previous projects to inform budget estimations, recognizing patterns in cost overruns and identifying areas where savings can be made.

Adopt an Agile Approach:

Implement agile methodologies not just in project management but in budget management as well. Agile budgeting allows for iterative reassessment and reallocation of funds based on project progress and changing requirements.

Monitor and Adjust in Real-Time:

Utilize financial tracking tools to monitor expenditures and project progress continuously. This enables immediate adjustments to the budget, preventing minor issues from escalating into major financial setbacks.

Emphasize Value Over Costs:

Focus on delivering value to the customer or end-user. This involves prioritizing project features and tasks based on their value contribution versus their cost, ensuring that the budget is spent on high-impact areas.

Maintain Transparent Communication:

Keep stakeholders informed about the project’s financial status, including potential risks and necessary budget adjustments. Transparency builds trust and facilitates smoother decision-making processes.

Involve Stakeholders in Financial Planning:

Engage stakeholders in the budgeting process to align expectations and secure buy-in for budget plans and adjustments.

Regularly Review Budget Performance with Stakeholders:

Conduct periodic reviews of the budget’s performance, discussing variances and lessons learned to improve future planning.

Conduct Post-Project Reviews:

After the completion of a project, conduct a thorough review to identify what went well and what didn’t in terms of budget management. This should involve all project team members and relevant stakeholders.

Document Lessons Learned:

Maintain a repository of lessons learned, especially those related to financial planning and management. This knowledge base becomes a valuable resource for improving budget accuracy and control in future projects.

Invest in Training and Development:

Encourage continuous learning among project managers and team members in financial management, agile methodologies, and risk analysis to enhance their skills in budget control.

Gain a holistic perspective:

Develop a comprehensive understanding of the entire project, including its scope, goals, and potential challenges. A holistic perspective ensures that budget considerations are aligned with the project’s overall objectives.

Data-Driven Decision-Making:

Embrace a data-driven mindset when making budget-related decisions. Utilize historical data, benchmarks, and performance metrics to inform decisions and enhance the precision of budget estimates.

Proactive Risk Identification:

Cultivate a proactive mindset toward risk identification. Anticipate potential risks and uncertainties that could impact the budget. Early identification allows for strategic risk mitigation planning.

Continuous Learning and Improvement:

Foster a culture of continuous learning within the team. Analyze past projects, identify areas for improvement, and apply insights to refine budgeting processes continually.

Post-Implementation Considerations:

Extend the budgeting mindset beyond development. Plan for post-implementation activities, including support, maintenance, and potential updates.

Client-Centric Collaboration:

Cultivate a client-centric mindset. Collaborate closely with clients, seeking regular feedback to align the software solution with their expectations and minimize the risk of costly revisions.

Efficient Resource Utilization:

Optimize resource utilization efficiently. Ensure that team members are aligned with their skill sets, avoiding unnecessary expenditures on underutilized or misallocated resources.

Pitfalls to Avoid

Over-Optimistic Estimates:

Unrealistically optimistic estimates can lead to missed deadlines and cost overruns. Be conservative in your projections.

Scope Creep:

Uncontrolled changes in project scope can disrupt budgets. Implement a change management process to handle scope changes effectively.

Underestimating Testing and QA:

Testing is crucial but often underestimated. Allocate sufficient resources for thorough testing.

There are many reasons why software projects end up in cost overruns. Here are a few statistics for the same:

- The cost overrun for software projects on an average is 27%.

- Communication breakdown is the reason for project failure in 57% of the projects.

- Problems with planning affect 39% of the projects.

Nuances of Software Development Budgets

Agile Budgeting:

Agile methodologies require adaptive budgeting. Frequent reassessment ensures alignment with changing priorities.

Flexible IT Architecture:

A rigid architecture can hinder agility. Invest in scalable systems that accommodate future changes.

Cultivate a Culture of Financial Discipline

Beyond individual mindset and tools, fostering a culture of financial discipline within the organization is critical. This involves setting clear economic policies, encouraging open discussions about budgetary concerns.

Benefits of Budget Control Mindset

Adopting a budget control mindset offers a range of benefits for individuals, teams, and organizations involved in project management and financial planning.

Here are key advantages associated with a budget control mindset:

Financial Stability:

Ensures financial stability by preventing overspending and unexpected financial setbacks.

Efficient Project Delivery:

Projects are delivered more efficiently when budget control is a priority. Teams can focus on achieving milestones without disruptions caused by unexpected financial challenges.

Improved Forecasting:

Enhances the accuracy of financial forecasting. Organizations can make more reliable predictions about future expenses, revenues, and overall financial performance, aiding in strategic planning.

Legal and Regulatory Compliance:

Adhering to legal and regulatory requirements is facilitated by a budget control mindset. Accurate financial tracking ensures compliance, preventing potential legal complications and associated penalties.

Enhanced Accountability:

Team members and stakeholders take responsibility for adhering to budgetary constraints, promoting a sense of ownership and responsibility.

Financial Confidence:

Instills confidence in financial management. Organizations and individuals can navigate financial challenges with assurance, knowing that they have the discipline and tools in place to control their budgets effectively.

Stakeholder Confidence:

Stakeholders, including investors, clients, and team members, have increased confidence in projects or organizations with a firm budget control mindset.

Promotes Long-Term Success:

Contributes to the long-term success of organizations. It establishes a foundation for financial sustainability, adaptability, and strategic growth, positioning the organization for continued success in a competitive landscape.

Cost-Effective Solutions With Acquaint Softtech

Hire remote developers from Acquaint Softtech for a cutting-edge software solution. Our expertise involves ensuring the stability and precision of your software budget.

Conclusions

Adopting a software budget control mindset is a multifaceted approach that requires proactive planning, agile financial management, stakeholder engagement, and a commitment to continuous learning.

Hiring a software outsourcing company like Acquaint Softtech will always work in your favor. In the dynamic world of software development, where uncertainty is the only constant, a budget control mindset is your compass, guiding your projects to financial stability and success..